- Home

- /

- News

- /

- The main legal steps of a contribution in kind

I. Define the key terms of the transaction

- Define the scope of the contribution in kind

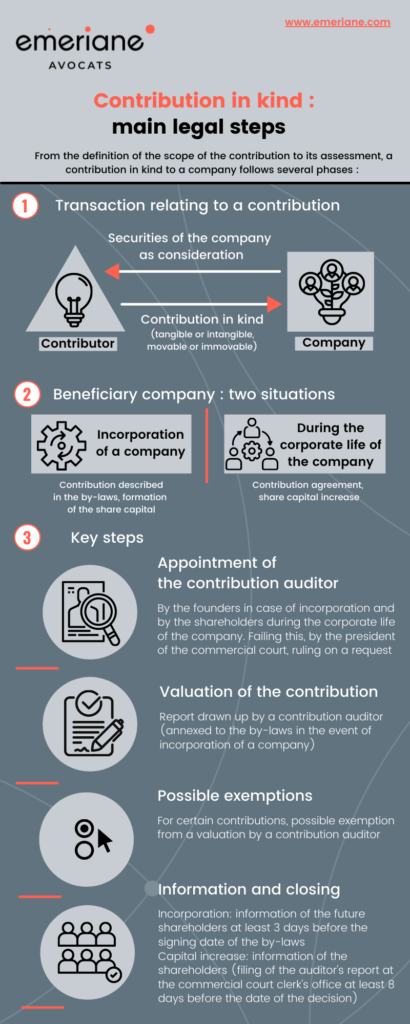

A contribution in kind is defined as the contribution of any asset (tangible or intangible, movable or immovable) that is not a contribution in cash or in the form of services, provided that this asset has a pecuniary value, is transferable and is not subject to any limitations provided for by law.

- Define the terms and conditions of the contribution in kind

The contribution in kind may be made in full ownership, usufruct, bare ownership or right to use.

When the contribution is made in full ownership, it is implemented by transferring to the company the ownership of the contributed assets and making them effectively available. In exchange for the contribution, the contributor receives securities of the company.

The contribution in kind can be made to a company in the process of being incorporated or during its corporate life (through a capital increase).

The contributor’s commitment to make the contribution is made in writing either in the articles of association (in the case of an incorporation) or in a separate deed (contribution agreement) in the case of an existing company or in the case of an incorporation. In the latter case, the deed will be annexed to the articles of association.

The transfer of ownership is definitively completed on the date of registration of the company with the Trade and Companies Register in the case of an incorporation or, in the case of an existing company, on the date of definitive completion of the capital increase.

II. Assess the contribution

As regards the valuation of the contribution in kind, the main risk lies in the overvaluation of the contribution (detrimental to the equality between shareholders but also to the company’s creditors, which could be misled about the company’s assets).

Such valuation is therefore subject to a special procedure (the one described below is applicable to French joint stock companies (sociétés anonymes), limited stock partnerships (sociétés en commandite par actions) and simplified joint stock companies (sociétés par actions simplifiées). A specific procedure applies for French limited liability companies (sociétés à responsabilité limitée).

III. Assess the fair valuation of the contribution in kind

- In case of incorporation

(i) Appointment of the contribution auditor

The articles of association must contain the valuation of the contribution in kind. This valuation must be carried out based on a report prepared by a contribution auditor (report annexed to the articles of association).

The contribution auditor must be appointed unanimously by the founders or, otherwise, by the president of the commercial court, ruling at the request of the founders or one of them.

(ii) Exemptions

For certain types of contribution in kind, an exemption from the valuation by a contribution auditor is available (asset contributed having already been the subject of a valuation by a contribution auditor within the 6 months preceding the contribution or in the event of a contribution of listed securities).

There are specific exemptions to the appointment of a contribution auditor for simplified joint stock companies (sociétés par actions simplifiées) by unanimous decision of the founders if (i) the valuation does not exceed EUR 30,000 for any of the contributions in kind; and (ii) the total value of all contributions in kind does not exceed half of the share capital.

As a consequence of the exemption or in the event the shareholders retain a value of the contribution different from the one provided by the contribution auditor: the shareholders remain jointly and severally liable, for a period of 5 years, vis-à-vis third parties, for the value retained for the contribution in kind at the time of incorporation of the company.

(iii) Information of the founders

The decision of the founders not to appoint a contribution auditor, and any documents relating to the description and valuation of the contribution must be made available to the future shareholders, at the address of the registered office, at least 3 days before the signing date of the articles of association.

Such documents must include a certificate stating that no change in circumstances has affected the valuation of the concerned contribution. The future shareholders may take copies of such documents.

- During the corporate life of the company

(i) Appointment of a contribution auditor

As in the case of the incorporation of a company, the completion of the capital increase by contribution in kind requires a valuation of such contribution based on a report prepared by a contribution auditor.

The contribution auditor is appointed unanimously by the shareholders or, otherwise, by the president of the commercial court, ruling at the request of any interested party.

(ii) Exemptions

As in the case of the incorporation of a company, an exemption from a valuation by a contribution auditor is available for certain types of contribution in kind (asset contributed having already been the subject of a valuation by a contribution auditor within the 6 months preceding the contribution or in the event of a contribution of listed securities).

(iii) Information of the shareholders

The decision of the management body of the company not to appoint a contribution auditor, and as any documents relating to the description and valuation of the contribution must be made available to the shareholders. Such documents must include a certificate stating that no change in circumstances has affected the valuation of the concerned contribution.

The documents must be made available at the address of the registered office and at the clerk’s office of the commercial court within the jurisdiction where the registered office of the company is located at least eight days before the date of the extraordinary general meeting called to decide on the capital increase.

Our team is at your disposal to assist you with all your corporate structuring needs to best structure your contribution operations.